When you sign a contract today, you might pay with Bitcoin. Or Ethereum. Or a stablecoin like USDC. But cryptocurrency in legal contracts isn’t just a tech novelty-it’s a legal minefield if you don’t know the rules. As of 2025, the U.S. has finally built a clear framework for how crypto assets are treated under the law. That changes everything for contracts. No more guessing if a Bitcoin payment is a gift, a security, or a commodity. The law now tells you exactly what it is-and how to write it into an agreement.

What the CLARITY Act Changed for Crypto Contracts

Before July 2025, drafting a contract with cryptocurrency was like building a house on sand. Courts were split. The SEC said some tokens were securities. The CFTC said others were commodities. A judge in New York ruled XRP wasn’t a security for retail buyers, but a different judge in California called Terra’s UST token a security. No consistency. No clarity. Businesses avoided crypto clauses altogether. The CLARITY Act (H.R. 3633) fixed that. It divided crypto assets into three clean categories:- Digital commodities: Assets like Bitcoin and Ethereum that derive value directly from blockchain functionality. Not securities. Not stablecoins. Just native crypto.

- Investment contract assets: Tokens sold with the expectation of profit from others’ efforts-like early-stage project tokens. These are regulated as securities by the SEC.

- Permitted payment stablecoins: Stablecoins pegged to the U.S. dollar and issued by regulated entities. These fall under banking regulators, not the SEC or CFTC.

How to Write a Crypto Payment Clause That Holds Up in Court

You can’t just say “Payment: 0.5 BTC.” That’s too vague. Courts need specificity. Here’s what a solid crypto payment clause looks like in 2025:- Name the asset precisely: Don’t say “crypto.” Say “Bitcoin (BTC) as defined under the CLARITY Act as a digital commodity.”

- Specify the blockchain: “BTC on the Bitcoin mainnet, version 2025.” This prevents disputes if the asset forks or moves to a sidechain.

- Define the payment window: “Payment due within 72 hours of invoice issuance, in BTC settled on-chain.”

- Include price conversion: “The equivalent value of $15,000 USD, based on the average price of BTC on Coinbase Pro over the 15-minute window ending at the time of invoice issuance.”

- State tax responsibility: “Buyer is responsible for all capital gains taxes arising from conversion of fiat to crypto.”

- Address volatility: “If BTC value drops more than 10% within 24 hours of payment, Seller may request additional collateral in USDC.”

Stablecoins Are the New Cash-But With Rules

Permitted payment stablecoins like USDC, USDT (issued by regulated entities), and newly approved Fed-backed tokens are now treated like electronic cash under the GENIUS Act of 2025. That means:- They can be used in contracts without triggering securities law.

- Issuers must be licensed by federal banking regulators (OCC or FDIC).

- Reserves must be held in U.S. Treasuries or cash equivalents, audited monthly.

Smart Contracts Aren’t Automatically Legally Binding

Many assume that if a contract runs on a blockchain-like a smart contract-it’s automatically enforceable. That’s false. In 2025, U.S. courts still require four traditional elements for any contract to be valid:- Offer

- Acceptance

- Consideration

- Mutual intent to be bound

State Laws Still Matter-Even With Federal Rules

The CLARITY Act is federal law. But 15 states passed their own crypto laws in 2025. New York’s BitLicense still requires businesses to get a license to handle crypto. Texas requires crypto transactions over $10,000 to be reported to the state. California mandates that crypto service providers disclose fees in writing. If your contract crosses state lines, you need to comply with all applicable laws. A contract signed in Florida with a vendor in California? You need to meet California’s disclosure rules. A payment processed in New York? You need a BitLicense-or you’re violating state law. This is why many businesses now include a “Choice of Law” clause: “This agreement shall be governed by the laws of the State of Texas, where the primary performance occurs.” It reduces legal chaos.

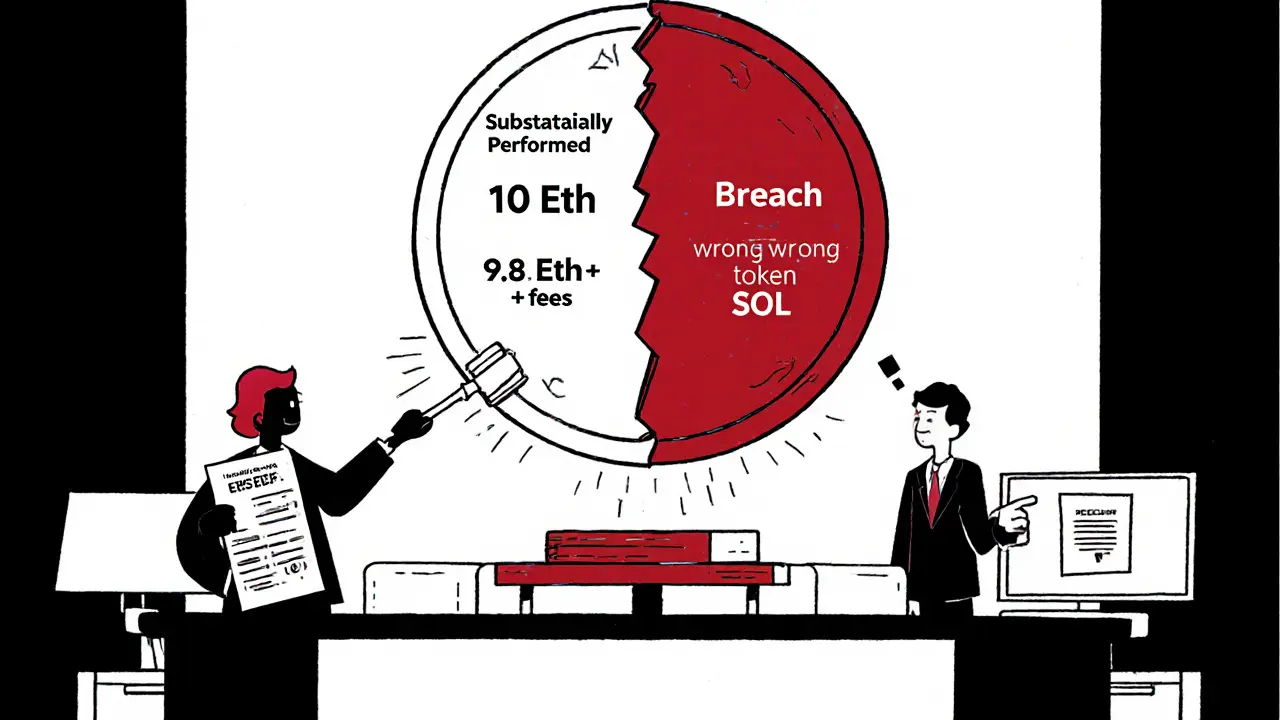

What Happens If Someone Doesn’t Pay With Crypto?

Let’s say you agree to accept 10 ETH for a service. The buyer sends 9.8 ETH. You refuse the payment. They sue you for breach. In 2025, courts look at whether the crypto amount was “materially deficient.” If the difference is less than 2% and due to network fees, most judges will rule the payment was substantially performed. But if the buyer sends the wrong token-say, sending SOL instead of ETH-that’s a failure to perform. You’re entitled to refuse it. The key is documentation. Always record the intended asset, amount, blockchain, and wallet address in writing. Use a timestamped digital receipt. If you’re using a platform like Stripe Crypto or Coinbase Commerce, their system logs are court-admissible evidence.What You Must Avoid

Here are three deadly mistakes lawyers are seeing in crypto contracts this year:- Using “crypto” as a catch-all term: Courts reject this. You must name the asset and its classification.

- Assuming blockchain immutability = legal finality: A transaction can be reversed by court order if fraud is proven. Blockchain doesn’t override U.S. law.

- Ignoring AML/KYC: If you’re a business accepting crypto over $3,000, you’re a financial institution under the Bank Secrecy Act. You must verify identity and report suspicious activity to FinCEN. Skip this, and you’re liable for fines up to $1 million per violation.

Future Trends: What’s Coming Next

The SEC and CFTC are now working on rules to allow crypto assets to be traded 24/7 on regulated platforms. They’re also testing “innovation safe harbors” for DeFi protocols-meaning decentralized lending and borrowing might soon be legally recognized in contracts. By 2026, we’ll likely see standardized crypto contract templates from the American Bar Association. But for now, the rule is simple: Be specific. Document everything. Know your asset’s legal category. And never assume blockchain means “unbreakable law.”Can I legally pay someone with Bitcoin in the U.S.?

Yes, you can legally pay with Bitcoin in the U.S. as of 2025. Bitcoin is classified as a digital commodity under the CLARITY Act, and payments in digital commodities are fully enforceable under contract law. However, the payment clause must clearly identify Bitcoin as the asset, specify the blockchain, and define how its USD value is calculated at the time of payment.

Are smart contracts legally binding?

Smart contracts are not automatically legally binding. U.S. courts still require traditional contract elements: offer, acceptance, consideration, and mutual intent. A smart contract can automate performance, but it must be tied to a written agreement that explains the legal obligations. Courts will not enforce code alone if one party didn’t understand the terms.

Do I need a license to accept crypto payments?

If you’re a business accepting crypto over $3,000 per transaction, you’re considered a money services business under the Bank Secrecy Act and must register with FinCEN. In New York, you also need a BitLicense if you’re storing, transmitting, or exchanging crypto on behalf of others. For individuals making personal payments, no license is required.

What’s the safest crypto to use in contracts?

Permitted payment stablecoins like USDC or USD Coin issued by regulated entities are the safest. They’re treated like electronic cash under the GENIUS Act of 2025, with strict reserve requirements and banking oversight. Unlike volatile tokens, they don’t trigger securities law or create price risk in contracts.

What happens if the crypto price crashes after I agree to accept it?

Unless your contract includes a volatility clause, you’re stuck with the agreed-upon value at the time of signing. For example, if you agree to accept 0.5 BTC worth $15,000, and Bitcoin drops to $10,000, you still receive 0.5 BTC. To protect yourself, include a price adjustment mechanism-like requiring additional collateral if the value drops more than 10% within 24 hours.

Can I sue someone for not sending crypto as promised?

Yes. If a party fails to deliver the exact crypto asset, amount, and blockchain specified in a written contract, you can sue for breach of contract. Courts in 2025 have upheld claims where parties sent the wrong token, underpaid due to network fees without agreement, or failed to settle on-chain within the agreed window.

Nathalie Verhaeghe

novembre 22, 2025 AT 09:38Je viens de rédiger un contrat avec un client américain en USDC, et je peux dire que la clarté du CLARITY Act change tout. Avant, je perdais des semaines à clarifier les termes. Maintenant, je copie-colle les modèles du site du CFTC et je vais boire un café. 😊

Arnaud Gawinowski

novembre 23, 2025 AT 10:56Encore une loi qui sert à protéger les banques et à embrouiller les petits porteurs. Les gars, on est en 2025 et on doit encore écrire des clauses de 15 lignes pour payer quelqu’un en BTC ? On dirait une comédie bureaucratique.

Andre Swanepoel

novembre 23, 2025 AT 23:35Je trouve ça fascinant comment les juristes américains ont réussi à intégrer la technologie sans la sacrifier. Le truc avec les stablecoins, c’est que c’est comme passer d’un chèque à un virement instantané, mais sans les frais de banque. Et le fait que les contrats intelligents ne soient pas automatiquement valables ? C’est une bonne chose. La technologie doit servir l’humain, pas le remplacer. J’ai vu des contrats déchirés parce qu’un gars a cliqué sur « accepter » sans lire un mot. Le code ne peut pas penser à la mauvaise foi.

Mehdi Alba

novembre 25, 2025 AT 18:05CLARITY Act ? T’as vu le nom ? C’est un piège. Les banques ont payé des lobbyistes pour créer ce vocabulaire. Bitcoin n’est pas un « digital commodity », c’est une monnaie souveraine. Le gouvernement veut vous faire croire qu’il peut catégoriser la liberté. Attends que la Fed lance son token… tu verras. Tous ces « permitted stablecoins » ? Des pièges à cons. Tu crois que USDC est sûr ? Tu sais qui contrôle Circle ? Des fonds de pension qui sont liés à la NSA. 😈

Djamila Mati

novembre 27, 2025 AT 15:11En France, on n’a pas encore de cadre clair. Mais je trouve que cette approche américaine est trop rigide. On réduit la créativité du crypto à des cases administratives. Le génie du blockchain, c’est justement qu’il échappe à la bureaucratie. On va finir par avoir des contrats avec 50 annexes et 12 signatures numériques pour payer un café.

Vianney Ramos Maldonado

novembre 27, 2025 AT 18:38Il convient de souligner que la réglementation fédérale, bien qu’indiscutablement nécessaire, ne saurait substituer à la primauté du droit civil dans les relations contractuelles. La notion de « mutual intent » demeure fondamentale, et toute tentative de la déléguer à un protocole algorithmique constitue une atteinte à la liberté contractuelle, telle qu’établie par le Code civil français, article 1101.

Laurent Rouse

novembre 28, 2025 AT 09:42Les Américains ont encore gagné. On est en 2025 et on doit encore suivre leurs lois pour faire un simple paiement. En France, on pourrait juste dire « je te paie en BTC » et c’est fini. Mais non, faut que tout soit codifié, vérifié, certifié, et signé par un notaire en ligne. Merci pour le cauchemar, les USA. 🤡

Philippe AURIENTIS

novembre 29, 2025 AT 03:32Je suis d’accord avec Nathalie. J’ai utilisé le modèle de clause avec la conversion en USD sur Coinbase Pro pour un client en Suisse. Aucun problème. Le truc qui m’a sauvé, c’est d’avoir mis la fenêtre de 15 minutes. Sinon, avec la volatilité de l’ETH, on se serait fait avoir. Et la partie sur les taxes ? Cruciale. J’ai eu un client qui a oublié de le mentionner… il a dû payer 8000€ de plus en impôts. C’est fou ce que quelques lignes peuvent éviter.

Denis Groffe

novembre 29, 2025 AT 18:06Le CLARITY Act c’est de la désinformation organisée. Tu crois que les gens comprennent ce que c’est qu’un « digital commodity » ? Personne ne sait ce que ça veut dire. Les juges non plus. Et les stablecoins ? Tu penses que les réserves sont réelles ? Regarde ce qui est arrivé à Terra. Ce n’est pas un problème de régulation, c’est un problème de confiance. Et la confiance, on ne la code pas. On la cultive. Et ici, on la vend comme un produit financier. Le système est corrompu. Il ne s’agit pas de crypto. Il s’agit de contrôle.

Jeremy Horn

novembre 29, 2025 AT 23:20Je travaille avec des artistes indépendants du monde entier, et je peux vous dire que les stablecoins ont changé ma vie. Avant, je devais attendre 3 jours pour un virement international, avec des frais de 20%. Maintenant, je paie en USDC, en 10 minutes, pour 0,10€. Et je leur donne un contrat simple en anglais, avec la clause de conversion, et ils comprennent. Pas besoin de traduire 15 pages. C’est magique. Et oui, je sais que ce n’est pas parfait. Mais c’est la meilleure chose qui nous soit arrivée depuis les paiements par PayPal. Et pour les contrats intelligents ? Je les utilise comme outils, pas comme lois. Le texte humain reste roi. Si tu veux que quelqu’un respecte ton contrat, écris-le en clair. Pas en code.

jerome houix

novembre 30, 2025 AT 09:15Le point sur la volatilité et le collatéral en USDC est essentiel. J’ai eu un litige l’an dernier où un client a refusé de payer la différence après une chute de 12%. J’ai cité la clause, et il a payé. Simple. Sans procès. C’est ça qui compte.